By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets.

Whatever doubts investors may have surrounding the longer-term economic damage of U.S. President Donald Trump’s proposed tariff agenda, they are giving his deregulation, tech-friendly and AI-supportive policies a huge thumbs up. Stocks are flying.

With strong earnings from streaming giant Netflix (NASDAQ:NFLX) providing an extra tailwind, Wall Street’s sizzling performance on Wednesday should fuel a strong rise in risk appetite across Asia on Thursday. It’s unlikely that a moderate rise in bond yields and the dollar will get in the way of that.

The S&P 500 leaped to a fresh peak of 6,100 points on Wednesday and lifted the Nasdaq above the 20,000-point barrier to within a whisker of December’s record high of 20,204 points.

The tech and artificial intelligence fervor is intensifying again after Trump announced a private sector investment of up to $500 billion to fund infrastructure for AI. Trump said that ChatGPT’s creator OpenAI, SoftBank (TYO:9984) and Oracle (NYSE:ORCL) are planning a joint venture called Stargate, which will build data centers and create more than 100,000 jobs in the United States.

Billionaire investor Stanley Druckenmiller told CNBC this week that optimism surrounding the U.S. market and business outlook is reaching “giddy” levels in boardrooms. Judging by Wall Street’s boom, that giddiness is being mirrored across trading floors.

Another reflection of investors’ bullishness and hunger for income is the record demand seen at French, Spanish and UK debt sales over the last 24 hours. Remarkably, bids for the roughly $37 billion worth of debt on offer totaled around $400 billion.

A large part of that is seasonal, as fixed income investors deploy their allocations for the year in January. But still.

These are the global forces on Thursday likely to drive Asian markets, where investors also have the first estimate of fourth-quarter and full-year South Korean GDP data, Japanese trade figures, the latest inflation reading from Singapore and industrial production numbers from Taiwan.

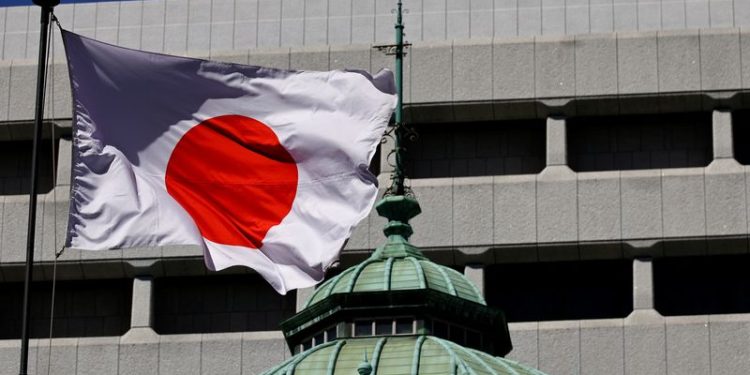

Thursday is also the last full trading day before the Bank of Japan’s policy decision. Financial markets are increasingly confident that the BOJ will raise its short-term policy rate on Friday by a quarter of a percentage point to 0.5%, a level last seen during the Global Financial Crisis.

Given its history, the BOJ could well couch any tightening of policy in cautious terms, making it clear that policy ‘normalization’ will be carried out carefully and gradually. If the Fed delivered a ‘hawkish cut’ last month, the BOJ may be poised to deliver a ‘dovish hike’ on Friday.

Dollar/Yen is trading towards the lower end of the 155.00-159.00 range it has been in for the past month, the two-year Japanese Government Bond yield is buoyant, and the Nikkei 225 index is hovering just below the 40,000-point mark.

Here are key developments that could provide more direction to markets on Thursday:

– South Korea GDP (Q4)

– Japan trade (December)

– World Economic Forum in Davos