By Samuel Shen and Jiaxing Li

SHANGHAI/HONG KONG (Reuters) – Chinese stocks opened higher and the yuan strengthened in a cautious start to Tuesday, as U.S. President Donald Trump’s inaugural policies suggested he will negotiate rather than immediately impose hefty tariffs on trading partners.

Trump returned to the White House on Monday with an ambitious agenda spanning trade reform, immigration, tax cuts and deregulation.

Trump didn’t target China in his inauguration speech nor did he immediately impose tariffs as previously promised, sparking a relief rally in global stocks and a drop in the dollar.

Trump directed federal agencies to “investigate and remedy” persistent U.S. trade deficits and unfair trade practices and currency manipulation by other countries.

But he said he might impose 25% tariffs on imports from Canada and Mexico on Feb.1.

Trump also signed an executive order delaying the enforcement of a ban on popular short-video app TikTok, but said he might impose tariffs on China if Beijing does not approve a potential U.S. deal with TikTok.

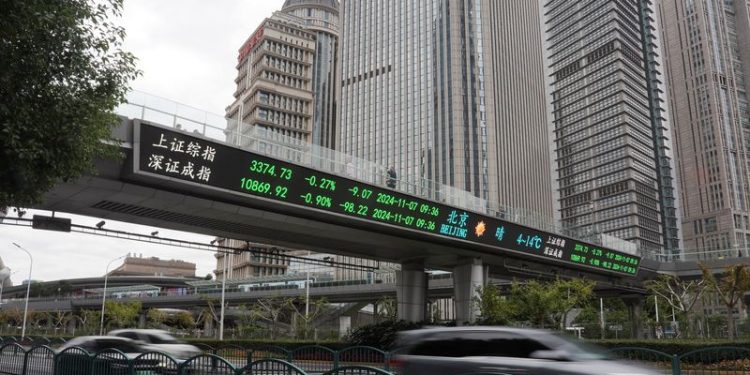

China’s blue-chip CSI300 Index rallied about 0.8% at the open, but was soon trading flat. The yuan was about 0.3% higher against a broadly weaker dollar.

“Previously, Trump was seen as dreadful. So once you see policies are less severe than thought, it’s good news to China assets,” said Yuan Yuwei, founder and CIO of Water Wisdom Asset Management, calling Trump’s return “marginally positive”.

Yuan also expects Trump to be less stringent in his crackdown against China than his predecessor Joe Biden, who “sought to strangle China to death.”

The CSI300 Index has dropped roughly 5% since Trump won the election on Nov. 5 with a threat to impose steep tariffs of 60% on Chinese goods, but had already rebounded over the past week amid gestures of goodwill between Beijing and Washington.

The yuan has weakened roughly 3% against the dollar since Trump’s victory but is trading near its strongest level in two weeks, buoyed by a friendly call between Trump and Chinese President Xi Jinping.

Kenny Wen, head of investment strategy at KGI Asia, said the “relief might not last long as no one knows if Trump will make some other wild cards. People don’t know if they should trust him or not.”