By Jamie McGeever

(Reuters) – A look at the day ahead in Asian markets.

The first full trading week of 2025 kicks off in Asia on Monday with the sharp slide in China’s currency and bond yields, an increasingly tense and fluid political situation in South Korea and a blocked U.S.-Japanese corporate merger all vying for investors’ attention.

A raft of purchasing managers index reports is also on deck, offering investors the first glimpse into how many of Asia’s biggest economies, including China’s, closed out 2024.

The global market backdrop looks relatively bright after Friday’s rebound on Wall Street, and equity and bond market volatility seems well-contained.

But emerging market currencies and assets are on the defensive, thanks to elevated U.S. Treasury yields and a soaring dollar. The greenback softened a bit on Friday, but it hit a fresh two-year high the day before and has rallied almost 10% in the last three months.

Much of the dollar’s appeal comes from the surge in long-dated U.S. Treasury yields since the Fed began cutting interest rates in September. The central bank’s 100 basis points of easing has been met with a rise of 100 bps in the 10-year yield, a remarkable turn of events that has bamboozled most investors – and likely policymakers too.

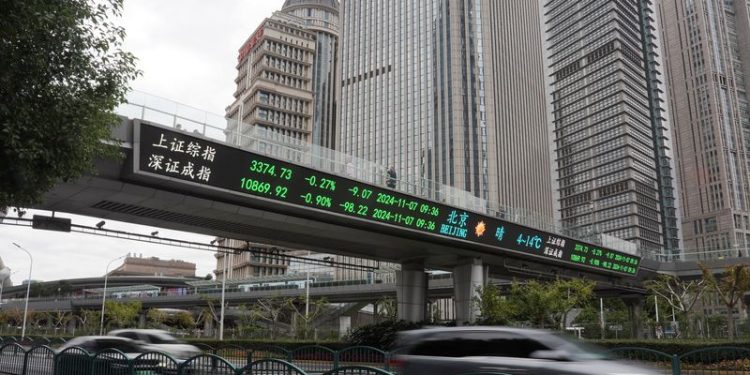

The picture in China could not be more different. As investors position for a year of policy easing and liquidity provision from Beijing, the yuan and bond yields are coming under heavy downward pressure.

Attention is focusing on the short end of the Chinese curve, with the two-year yield on the brink of breaking below 1.00%. It is already the lowest on record, having tumbled 50 bps in the last two months and 100 bps since last March. The psychological 1.00% barrier could break on Monday.

In this context, Chinese inflation data later this week will take on even greater significance, and a Reuters poll suggests annual consumer inflation in December held steady at 0.2%. Although China’s economic surprises index has been rising in recent weeks, markets will be highly sensitive to added deflationary pressures.

The spot yuan on Friday slid to a four-month low, breaking through the 7.30 per dollar level that the People’s Bank of China had appeared to be defending. A move through 7.35 per dollar would signal a fresh 17-year low.

Selling pressure on the yuan looks pretty strong, as evidenced by the spread between the spot dollar/yuan rate and the central bank’s daily fixing. It is now the widest since last July, hovering around its widest levels on record.

Are authorities in Beijing getting nervous? The central bank on Friday warned fund managers against slamming bond yields even lower, amid worries that a bubble in bonds might undercut Beijing’s efforts to revive growth and manage the yuan.

Here are key developments that could provide more direction to markets on Monday:

– China, Japan, India, Australia services PMIs (December)

– Thailand inflation (December)

– Vietnam GDP (Q4)