Investing.com — The Federal Reserve will “get pushed into deeper” interest rate reductions later this year following an aggressive borrowing cost cut by the central bank, according to analysts at Bank of America.

The Fed slashed interest rates by 50 basis points to a range of 4.75% to 5.0% on Wednesday and indicated that it would announce further cuts this year, signalling the beginning to an easing cycle aimed at shoring up the economy following a prolonged battle against surging inflation. Rates had previously been at a 23-year high for over a year.

Along with the first cut since March 2020, an updated “dot plot” of officials’ policy forecasts showed that policymakers now expect the benchmark fed funds rate to dip to 4.25% to 4.5% by the end of 2024. This would suggest either another jumbo half-point rate cut or two smaller quarter-point cuts at either of the Fed’s two remaining gatherings this year.

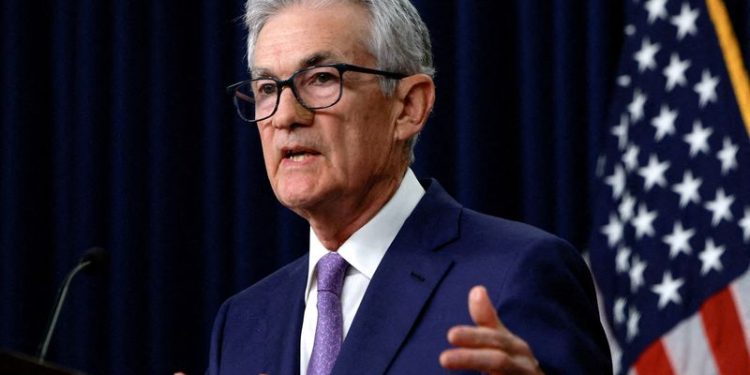

At a press conference, Fed Chair Jerome Powell downplayed concerns about a recession, pointing to resilient economic growth, cooling price gains and a “solid” labor market.

“The US economy is in a good place and our decision today is designed to keep it there,” Powell said.

However, Powell said the Fed was carrying out a “recalibration” of its rate policy and not instituting a “new pace” of drawdowns. He added that the rate-setting Federal Open Market Committee was not in a “rush” to slash borrowing costs.

The BofA analysts described the announcement as a “hawkish cut,” with the Fed’s outlook for rate cuts in 2024 not as deep as wider market expectations.

Even still, the analysts predicted that the Fed will likely be keen to avoid disappointing investors by not unveiling sufficiently large rate reductions at its coming meetings.

“Therefore, we now expect another 75 [basis points] of cuts in [the fourth quarter], and 125 [basis points] of cuts in 2025, for a neutral rate of 2.75-3%,” the BofA analysts said in a note to clients. The neutral rate is the theoretical level at which borrowing costs neither help nor hinder economic activity.